Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This morning I was watching an interview on C-SPAN with Steve Forbes, President and CEO of Forbes Media. Towards the end of the segment, Mr. Forbes offered the following advice for stock investors:

Don't try to be a timer, especially with your retirement money. Timing is a loser's game. Consistency wins. Emotions are your enemy. People too often leave the market when things get bad. (They) get in when things are good and then they get whip-sawed and they end up under-performing the market. Steadfastness is the key.

Well Mr. Forbes, your comments are spot-on (exactly correct)!. As most of my readers know, I am a disciple of Benjamin Graham and like Mr. Graham (and Mr. Forbes) I am always looking for a "margin-of-safety" in which I can wait patiently for storms to subside, knowing that a sunnier and more plentiful time is bound, as a law of nature, to resume in due course. As Mr. Forbes explained:

Consistency is the key?especially with your retirement money.

REITs Provide Investors with Durable and Reliable Income

We are just a few days away from 2013 and as I wrote in a recent Forbes.com article:

The uncertainty of the expiring Bush Tax Cuts will bring REIT investor income and other taxable (non-REIT) dividends into tax parity (assuming congress makes no further changes to these rules) and both revert to being taxed at ordinary income rates. It is likely that the demand for tax preferred qualifying dividends will shift partly over to REITs as the tax advantage is removed, that increased demand is likely to provide a tail wind for REIT share values.

Of course the primary attraction to REIT dividends is the fact that there are no options for companies to pay or not to pay a dividend, since by law, REITs are forced to pay out at least 90% of their otherwise taxable income. The dividends that REIT investors receive out of earnings haven't been reduced by taxes at the corporate level, making REITs tax-efficient conduits for real estate income. Simply said, REITs are forced to do so to retain their REIT status.

Alternatively, non-REITs are less consistent in that companies can decide to pay, sustain, or cut dividends. With the threat of the Fiscal Cliff and the many uncertainties ahead, these non-REIT payers can choose to conserve cash and very possibly cut dividends in 2013 or at least not increase them. Ben Graham explained his theory of dividends in The Intelligent Investor:

Paying out a dividend does not guarantee great results, but it does improve the return of the typical stock by yanking at least some cash out of the manager's hands before they squander it or squirrel it away.

My Intelligent Year-End Picks

This year I decided I would put together a year-end summary of the best REITs of 2012. As my frequent readers know, I am a regular contributor for Seeking Alpha, The Street, and Forbes.com. Collectively, I have written over 250 articles in 2012 and most of the articles have been focused on equity REITs. In addition to considerable research and analysis, I have interviewed many high ranking CEOs and CFOs, all in an effort to deliver sound investment recommendations for my readers and followers. Starting in 2013, I plan to publish a newsletter with Forbes Media in which I will provide quantitative analysis that will include a managed portfolio of over 40 REITs (including preferred issues).

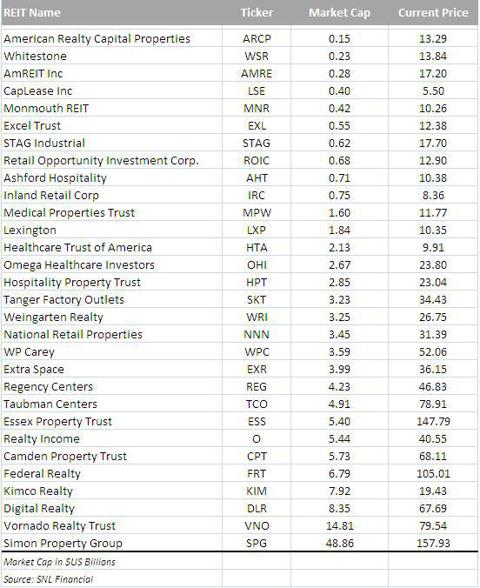

I have summarized below 30 REITs that I have researched in 2012.

(click to enlarge)

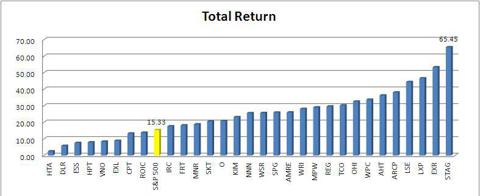

Year-to-date most (22) of the 30 REITs beat the S&P 500 average of 15.33%. STAG Industrial led the pack with a whopping 65.45% return; followed by Extra Space (EXR) at 53.32%, Lexington Realty Trust (LXP) at 46.61%, CapLease Inc. at 44.42%, and American Realty Capital Properties (ARCP) at 38.09%. (Note: Healthcare Trust of America (HTA) listed less than a year ago so the company has not been trading for the same time as the peer group).

(click to enlarge)

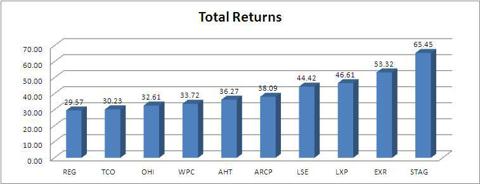

Here is a close-up of the top 10 total return performers:

(click to enlarge)

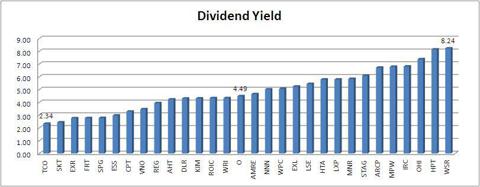

The 30 REITs referenced have a wide variance of dividend yields ranging from the lowest yielder, Taubman Centers (TCO) paying 2.34% up to the highest ticket REIT, Whitestone REIT (WSR) paying 8.24%. The Monthly Dividend Company, Realty Income (O), is in the middle of the pack paying 4.49%.

(click to enlarge)

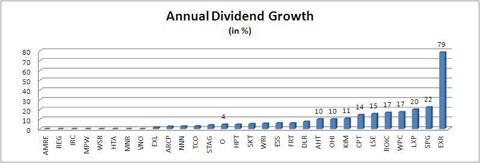

I have found that one good approach to balancing your REIT portfolio is to filter the companies that command the best growth potential. Traditionally, REIT investors have been attracted to the asset sector, in substantial part, for their stable and rising dividends, and a significant dividend yield remains important to most investors. Here is a snapshot of the 30 referenced REITs with the highest growth candidates including Extra Space at 78.57%, Simon Property Group (SPG) at 22.22%, Lexington Property Trust at 20.0%, W.P. Carey (WPC) at 17.23%, and Retail Opportunity Investment Corp (ROIC) at 16.67%.

(click to enlarge)

In a previous Seeking Alpha article (and one of my most read), REITs Poised to Become More Attractive in 2013 and Beyond, I wrote:

The major factor that dampens the volatility of REIT stocks is the fact that they pay out higher dividend yields. When a stock yields next to nothing, its entire value is comprised of all future earnings, discounted to the present date. If the perceived prospects for this earnings decline just slightly, the stock can plummet quickly. Much of the value of a REIT stock, however, is in the REIT's current dividend yield, so a modest decline in future growth expectations will have a more muted effect on its trading price.

Sometimes, our biggest investment mistakes tend to be the result of fear. When stocks are going up, it's human nature to ignore risk in our pursuit of ever greater profits. But, when stocks are dropping, we often tend to panic and dump otherwise sound investments because we're afraid of ever greater losses.

Risk is inescapable and it is impossible to eliminate all investment risk; however, Ben Graham's methods of greatly minimizing risk, by filtering out disadvantageously positioned securities from the outset, have proven to be extraordinarily successful. As we learned from The Great Recession, it takes only a few large losses to decimate overall investment performance, even if many other investments prove successful.

I wish you all the best of luck in 2013 and I hope that my articles have been beneficial. I consider my research and writing successful if, "upon thorough analysis, (the securities) promise safety of principal and a satisfactory returns (Graham)." For as Steve Forbes said, "consistency wins" and I trust that you will stay focused on this message and heed the intelligent advice of the legendary investor Ben Graham,

You are neither right nor wrong because the crowd disagrees with you. You are right because the data and reasoning are right.

Happy New Year!

Source: SNL Financial

Other REITs mentioned: (WRE), (AMRE), , (REG), (FRT), , (EXL), (HPT), (AHT), (IRC), (KIM), (OHI), (MPW), (NNN), (SKT), (LSE), (STAG), (VNO), (CPT), (ESS), (DLR), and (MNR).

Source: http://seekingalpha.com/article/1085291-intelligent-reit-investing-consistency-always-wins

kenny rogers avatar the last airbender david wright cory booker cubs cj wilson ellsbury

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.